Inventory Categories

Inventory categories are a convenient way to describe, compartmentalize and configure like groups of inventory items. For example the category Dues will contain all dues items which are to be billed to members. In another example the category Retail Merchandise might have subcategories for hard goods, soft goods and services. There are no rules as to how you set up your category structure. Build and use it to meet the specific business and reporting needs of your club

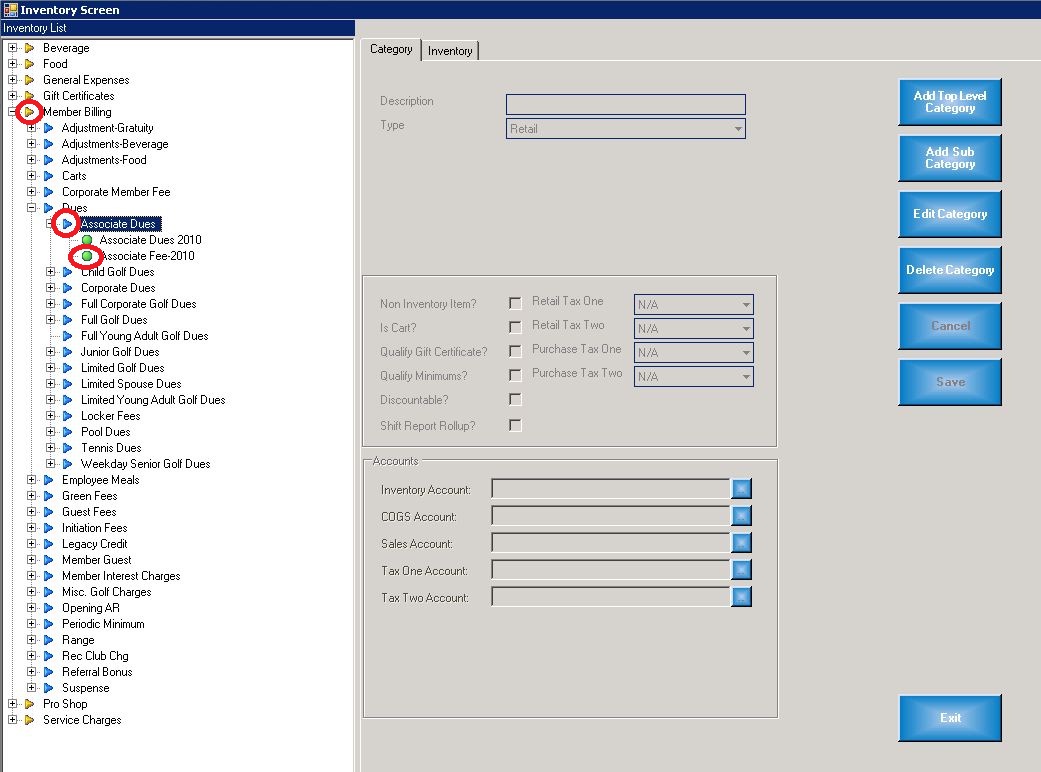

Launch Inventory Manager

From the Outlook Bar, click on Options, Inventory, then Inventory Manager. The following form will load:

The tree view control on the left facilitates navigation through the category structure to the the inventory items. Top level categories have a gold arrow beside them, sub-categories have blue arrows and inventory items have a green ball.

Category Types

There are four category types, with each type fulfilling a specific function.

- Retail. Retail inventory items are used in conjunction with the retail point of sale system.

- Member Billing. Member Billing items are used in conjunction with the Billing Manager and are used to bill members for items such as dues and assessments.

- Food & Beverage. Food & Beverage items are used in conjunction with the Food & Beverage point of sale system.

- General Expenses. General Expense items are used in conjunction with the Purchase Order system, to process vendor invoices to Accounts Payable and the General Ledger.

Category Hierarchy

Each inventory category can spawn a child category. This provides a great deal of flexibility in designing and building your inventory tree.

Category Information

| Item | Description |

| Description | This field contains a descriptive name for the category |

| Type | Select an Inventory Type (as described above) |

| Non Inventory Item | Leave the check-box unchecked, if you will be tracking the purchase and sale of inventory items. As an example, if you are tracking the purchase and sale of golf balls, leave this un-checked. On the other hand, if you are creating a sales item for member dues or golf lessons, check off this field. |

| Is Cart? | Check this field if the items in the category are golf cart rentals and you want to print a waiver on the sales receipt. |

| Qualify Credit Book | Check this field, if the purchaser can use their credit book balance to purchase the items in this category. |

| Qualify Minimum? | Check this field if the purchase of items in this category apply against the member's food & beverage minimum. |

| Discountable? | Check off this field if the items in the category qualify for member discounts (e.g. Mill River plan) |

| Shift Report Roll up? | Verify what this is for |

| Retail Tax One | Select the retail tax rate which will apply to the items in this category. |

| Retail Tax Two | If there are two taxes in your jurisdiction, select the tax rate for the second tax. |

| Purchase Tax One | In jurisdictions where there is Value Added Tax (VAT) and you are entitled to input tax credits, select the applicable tax rate. |

| Purchase Tax Two | If there are two taxes in your jurisdiction, select the tax rate for the second tax (highly unlikely). |

| Accounts | Select the applicable account for the general ledger account types below |

| Inventory Account | When inventory items in the category are purchased, the purchase transaction will debit the account selected. When the items are sold, this account will be credited with the applicable amount for cost of goods sold. |

| COGS Account | When Inventory items in this category are sold, this account will be debited for the cost of goods sold and the Inventory account will be credited with an equal amount. |

| Sales Account | When Inventory items in this category are sold, this account will be credited with the sales amount. |

| Tax One Account | When Inventory items in this category are sold, this account will be credited with the tax one amount. |

| Tax Two Account | When Inventory items in this category are sold, this account will be credited with the tax two amount. |

Related Links

Prerequisites